Learn the Buffett

Accelerator Framework

Used by 7-Figure Investors to Consistently Earn 25-30% Annual Returns from the Stock Market.

Proven Since 1979!

I’m a 7-figure investor, and I’ve built my wealth on 1 proven system:

I’m a 7-figure investor, and I’ve built my wealth

on 1 proven system:

THE BUFFETT ACCELERATOR FRAMEWORK

THE BUFFETT ACCELERATOR FRAMEWORK

It's Delivered 25-30% Annualized Return

— Consistently Since 1979!

That’s Delivered a Shocking 25-30% Annualized Return — Consistently Since 1979!

Dear Current and Future Investors,

What I’m about to share is a proven investing framework that has helped me steadily grow my portfolio and achieve financial freedom through the stock market...

Value investing.

Spotting great companies at great prices.

Value investing.

Spotting great companies at great prices.

Its the same exact strategy Warren Buffett use to build wealth!

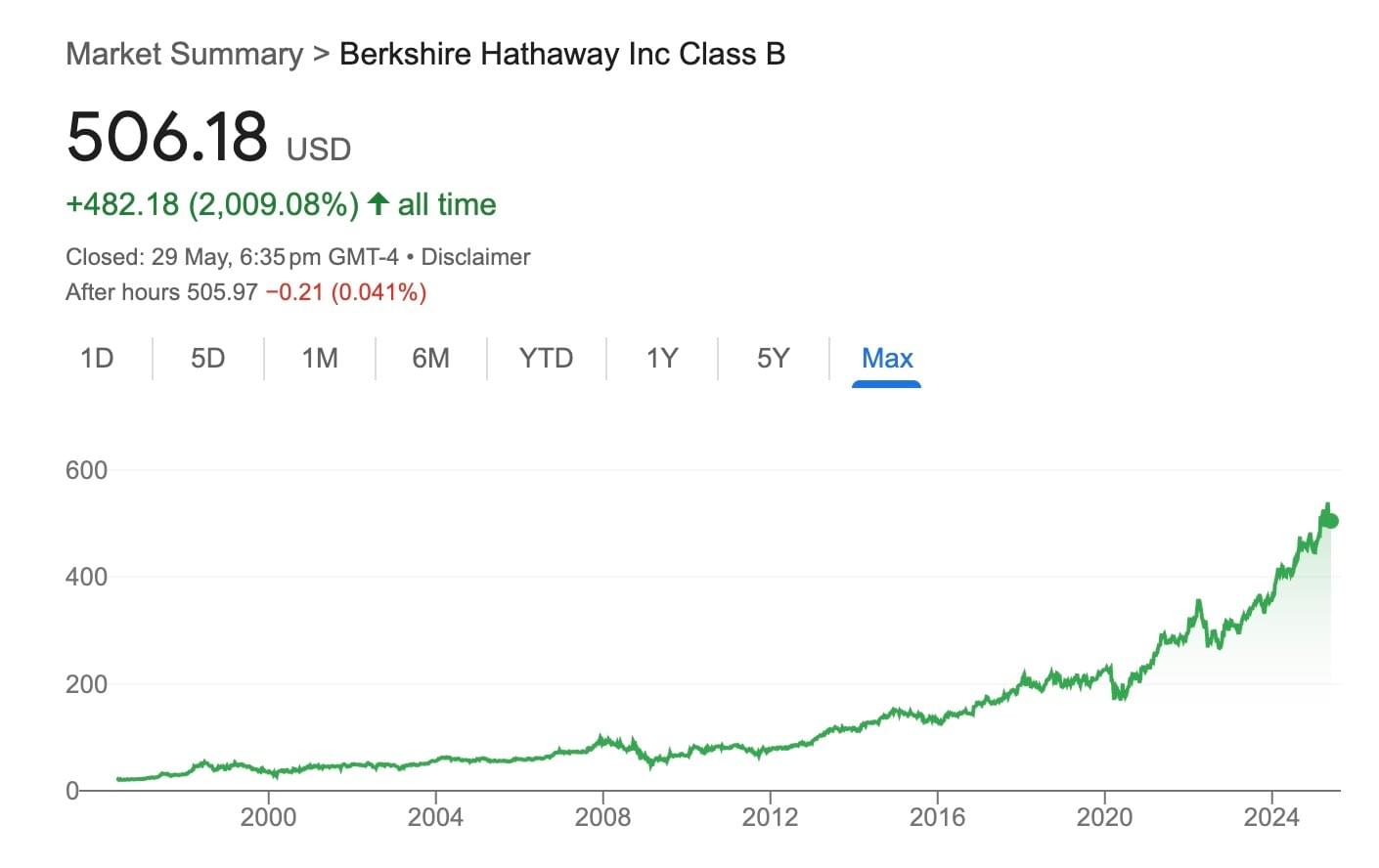

Just look at Berkshire Hathway...

Class B shares of Berkshire Hathaway started trading in 1996.

If you had invested in Berkshire back in 1996, you would have more than 21x-ed your capital!

That's the power of value investing...

While value investing builds your foundation and lays the groundwork…

What most people don't know is Buffett doesn’t just invest in great companies.

He also uses options to boost returns and manage risk.

It’s one of the biggest reasons he’s outperformed for decades.

When used the right way, Options don’t replace value investing — they enhance it, supercharging your portfolio performance.

We call this the Buffett Accelerator Framework:

1) One that drives long-term growth through quality stock selection.

2) The other generates consistent cash flow through strategic options plays — even in sideways or choppy markets.

For example... you’d like to own a stock but only at a cheaper price.

Instead of just waiting, you can use the B.O.S.S. options strategy.

You agree to buy a quality stock at a price you’re comfortable with, but you get paid upfront for making that promise.

If the stock price falls to or below your target, you buy it at your ideal price, effectively getting in cheaper, plus you keep the premium you were paid.

If the stock price doesn’t drop, you keep the premium as income, with no obligation to buy.

It’s a win either way.

Or...

Let’s say you want to buy 100 shares at $50? That's $5,000 Investment.

With Strategy Y, you can control the same 100 shares for just $1,250.

If the stock goes up, your profit is similar.

If it crashes, your maximum loss is only $1,250, not $5,000.

More upside, 75% less capital at risk.

These are calculated options strategies that fit right to brilliantly enhance the value investor’s playbook.

Think of it like this: value investing builds your engine, but options install a turbocharger, transforming a solid ride into a high-performance machine.

You’ll Learn These in Our Upcoming

Live Buffett Accelerator Masterclass For Free!

You’ll Learn These in Our Upcoming Live Buffett Accelerator Masterclass For Free!

If you’re new to investing, this is a great place to start.

If you’re an experienced investor, the Buffett Accelerator Masterclass will serve as a helpful refresher to optimise your portfolio for higher returns in 2025.

Here’s what you’ll learn during the Free 2-Hour Masterclass:

- The Buffett Investing 101: The lost fundamentals behind Berkshire Hathaway's value investing success to spot undervalued companies and build long-term wealth.

- The 3 Numbers That Matter: Instantly assess whether a stock is worth investing in using just 3 key metrics that even beginners can apply.

- The Buffett Options Secret Strategy (B.O.S.S.): Earn up to 3.6% ROI monthly while waiting to buy quality stocks at your ideal price.

- How to Use Smaller Capital for Bigger Upside: To control 100x more shares at a fraction of its cost.

I'll also dive deep into the psychology of how ultra high net worth investors manage drawdowns in their portfolio.

Doesn’t that sound exciting?

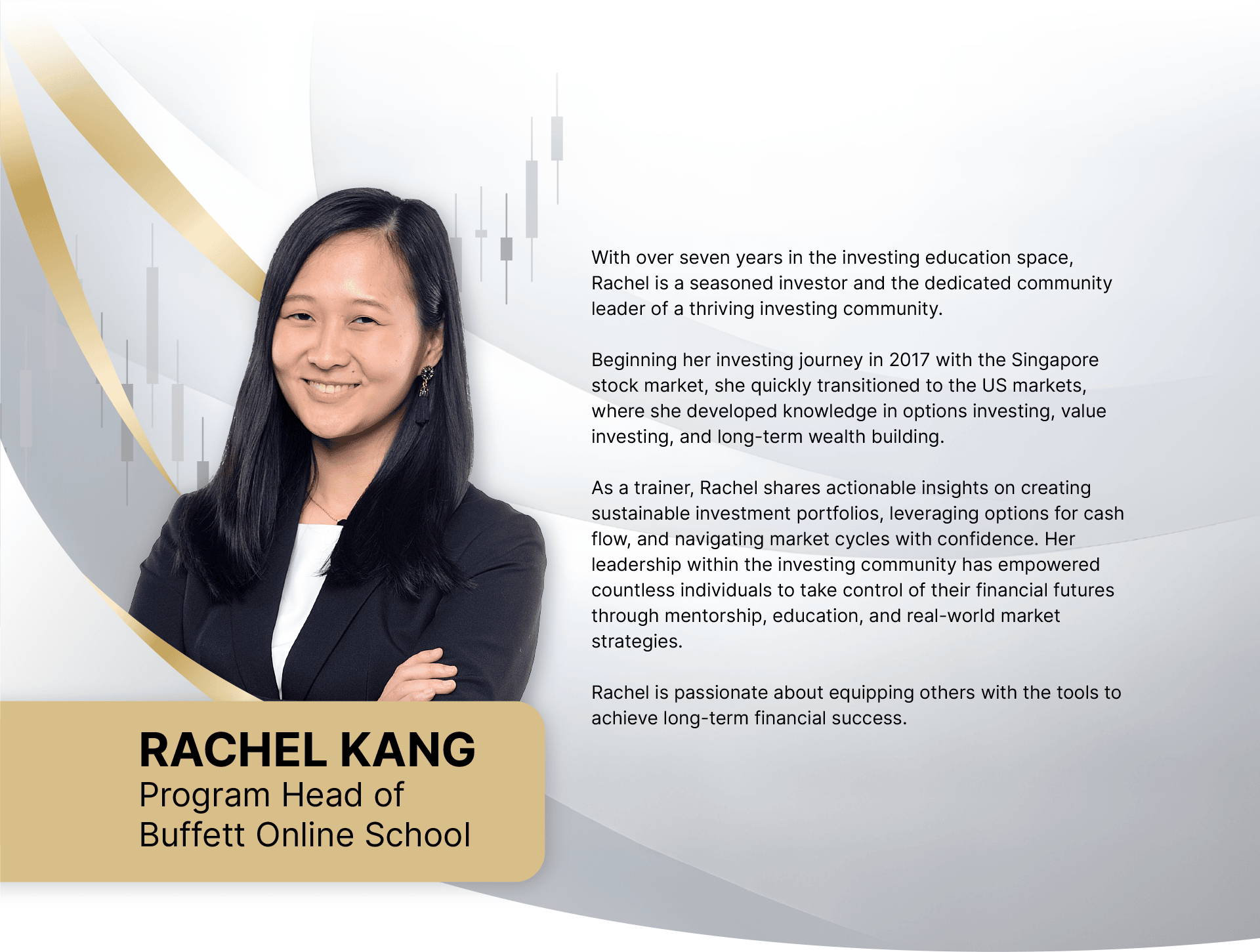

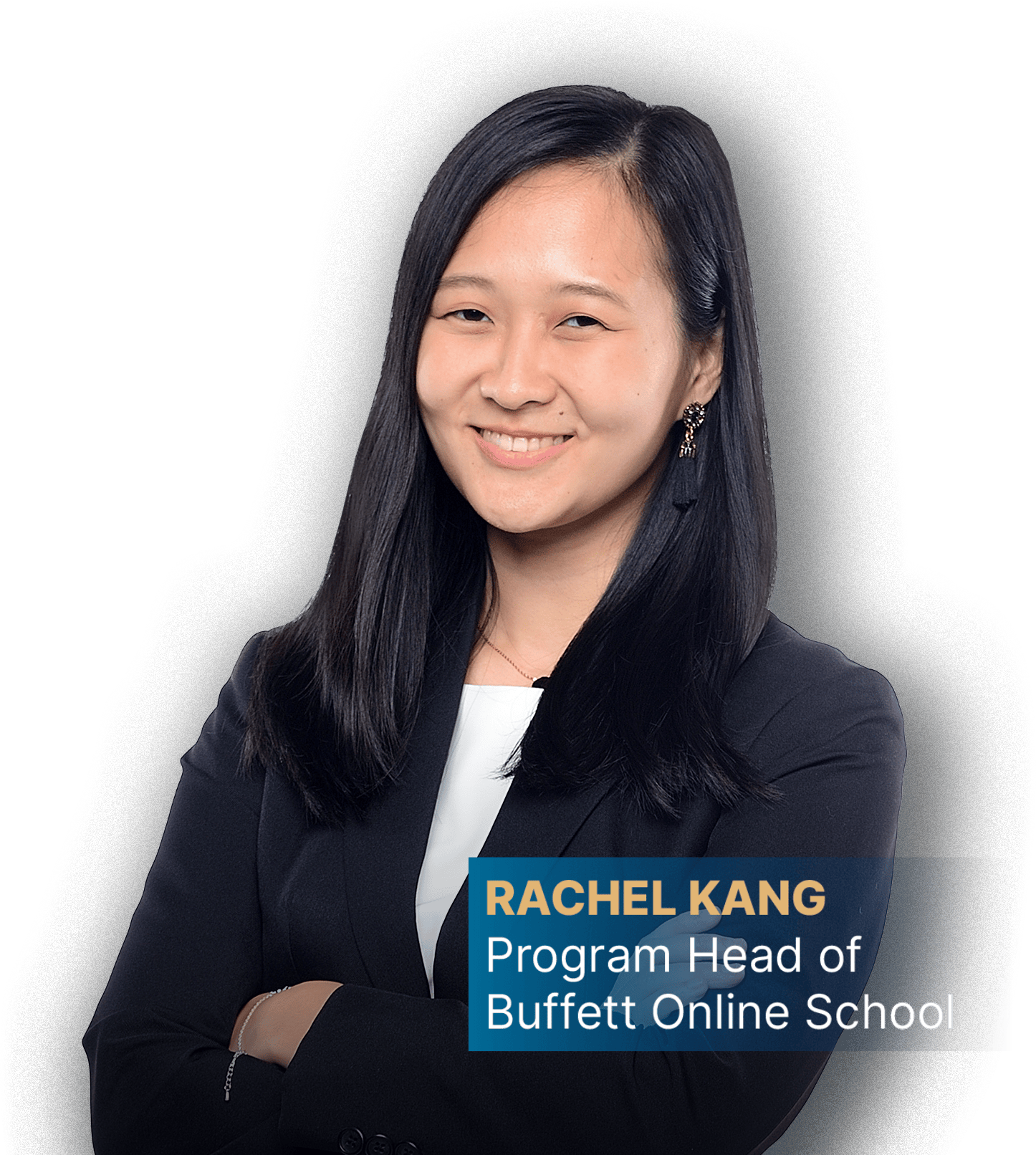

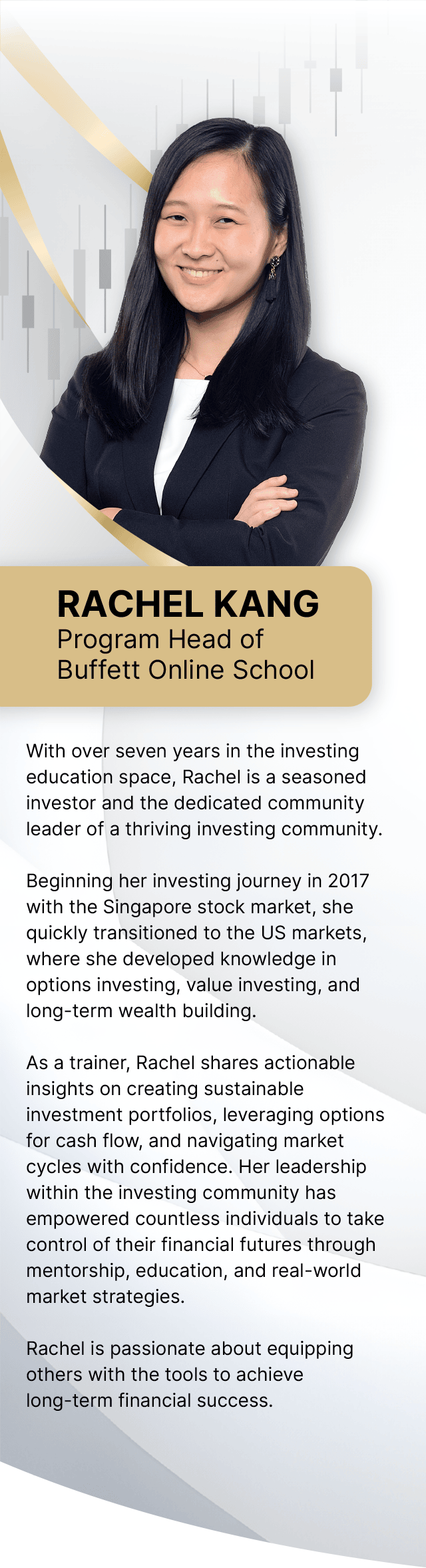

Meet Your Buffett Online School Trainer

Meet Your BOS Trainers

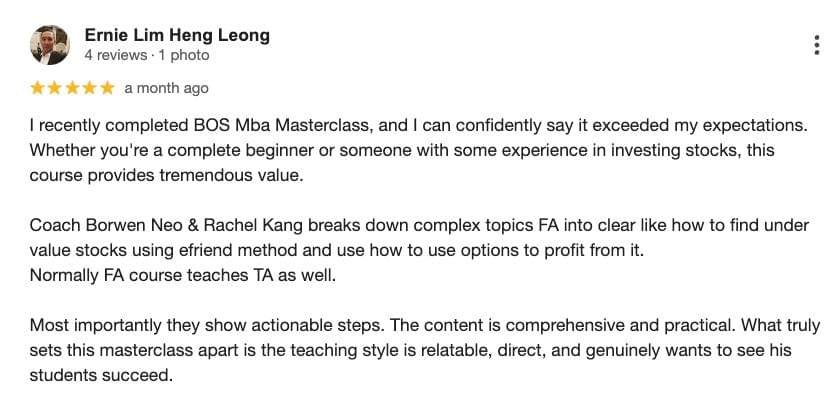

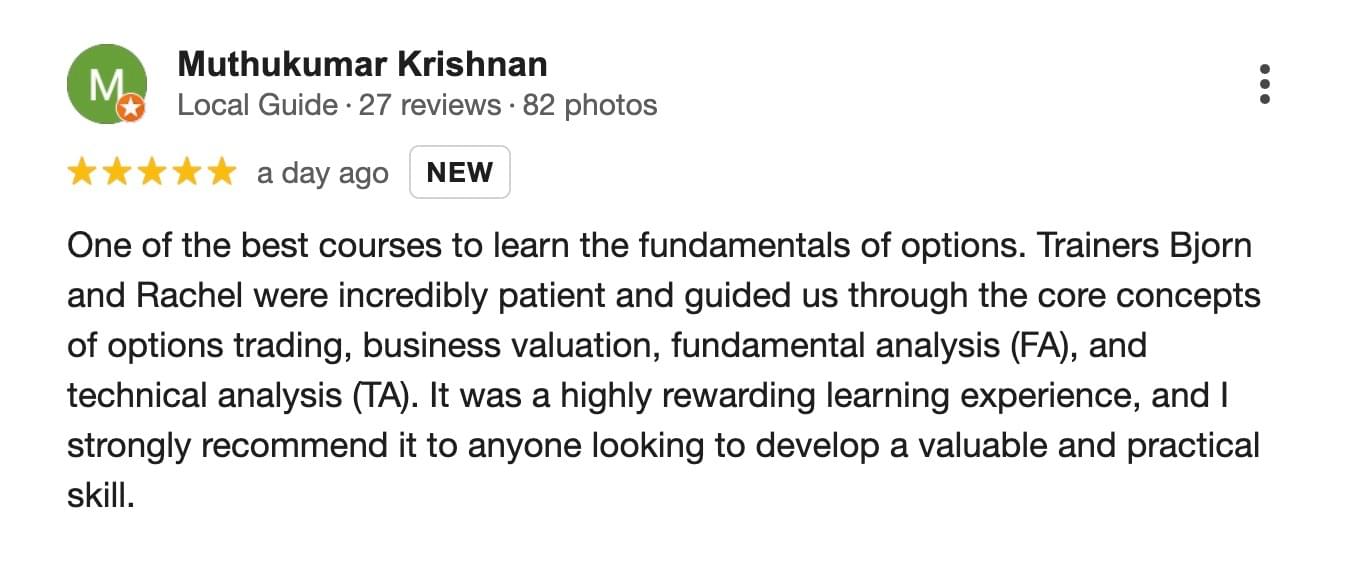

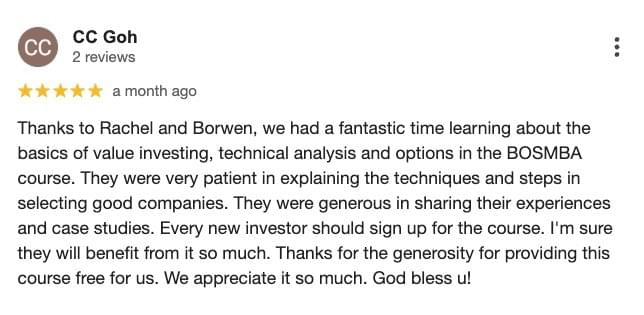

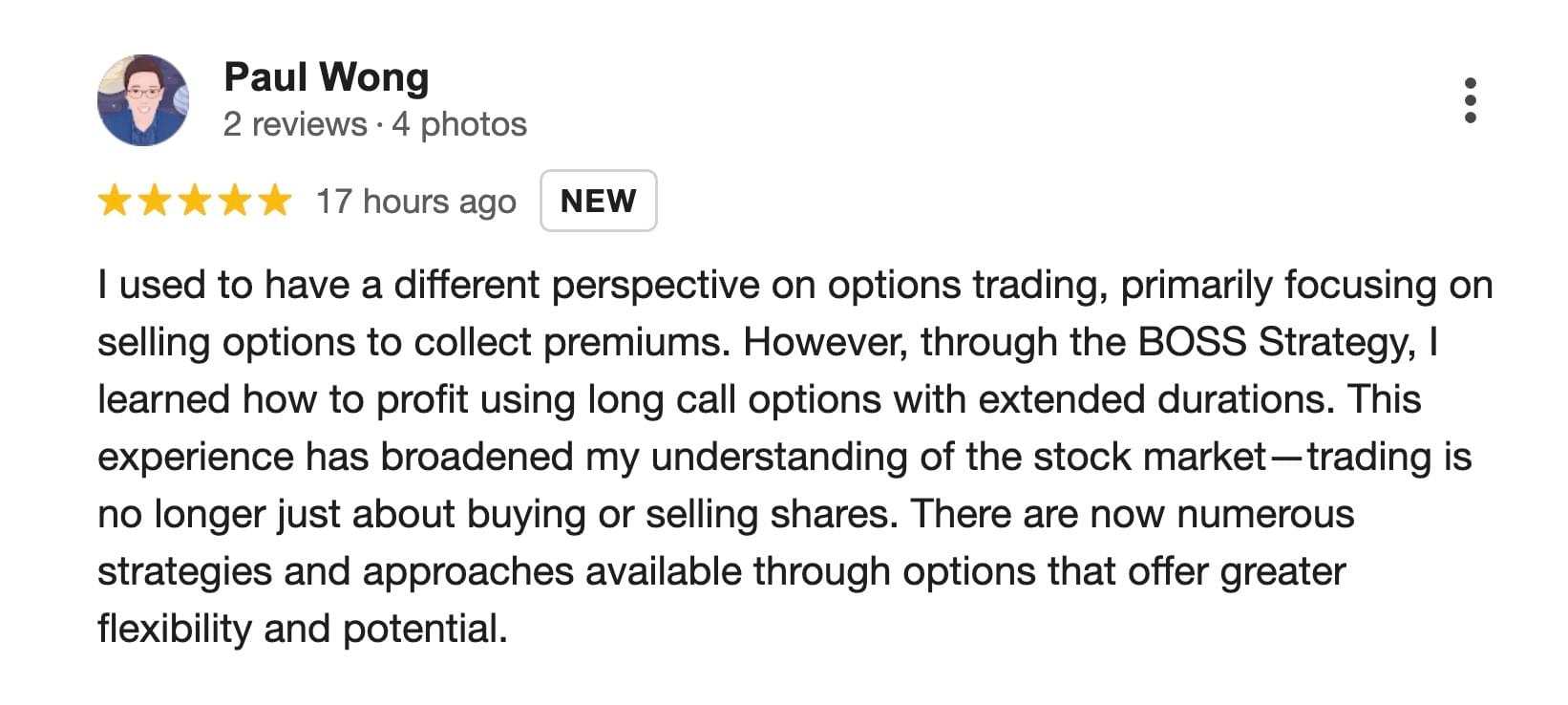

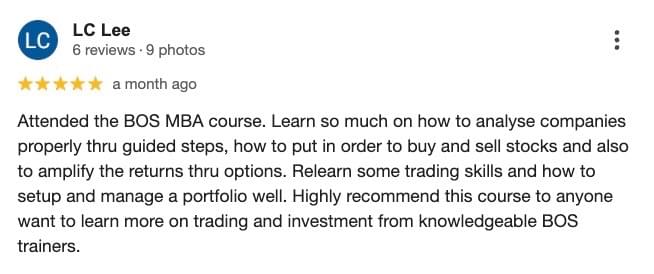

What Our Students Say

Want To Grab The Huge Opportunities In The Stock Market Now?

Want To Grab The Huge Opportunities In The Stock Market Now?

Now you might be on the fence about this…

So let me tell you something:

No matter how the market moves, opportunities for smart investors always exist.

The real question is, do you know how to seize them?

With the Buffett Accelerator Framework, you can find quality stocks and generate steady income, regardless of market conditions.

If you're ready to make your portfolio work harder and smarter in today’s complex market...

👉 Join the Buffett Accelerator Masterclass today.

Cheers to your wealth,

Rachel Kang

Program Head of Buffett Online School

Next Level Academy | Copyright © 2025 | All Rights Reserved

This website is developed and operated by Mary Buffett Business Pte. Ltd. We are an Education company and hence is NOT regulated or licensed by MAS as we do not provide investment services. All forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone. You are recommended to seek advice from a professional financial advisor if you have any doubts.