Learn About Buffett Online School’s

All-New Prestigious BOS MBA 2.0 Program Today

Learn About Buffett Online School’s All-New Prestigious BOS MBA 2.0 Program Today

I’m a 7-figure investor, and I’ve built my wealth on 1 proven system:

I’m a 7-figure investor, and I’ve built my wealth

on 1 proven system:

THE BUFFETT ACCELERATOR FRAMEWORK

THE BUFFETT ACCELERATOR FRAMEWORK

That’s Delivered a Shocking 20% Annualized Return, Consistently Since 1979!

That’s Delivered a Shocking 20% Annualized Return, Consistently Since 1979!

Dear Friend,

What I’m about to share might sound “old-fashioned” or “outdated” in today’s fast-moving world of AI hype and meme stocks...

But this time-tested investing framework has been my foundation for steadily growing my portfolio, and securing my financial freedom...

The Last Few Years Have Shaken New Investors Like Never Before

The Last Few Years Have Shaken New Investors Like Never Before

Shortly After? Many New Investors Got Burned Badly.

The Market Today Is NOT What It Seems

Because here’s the truth:

The stock market behaviour in the past few years is NOT the norm.

It was caused by a massive injection of capitals— not by strong business fundamentals.

Which caused the share price of most companies to go up!

Now that the stimulus has faded, the market has shifted.

Many companies are trading at fair or even overvalued prices — despite slowing growth.

So, instead of chasing short-term rallies that may not last, here’s what truly successful investors focus on to grow their wealth consistently.

What Experienced Investors Do To Grow Their Wealth Regardless Of Market Conditions…

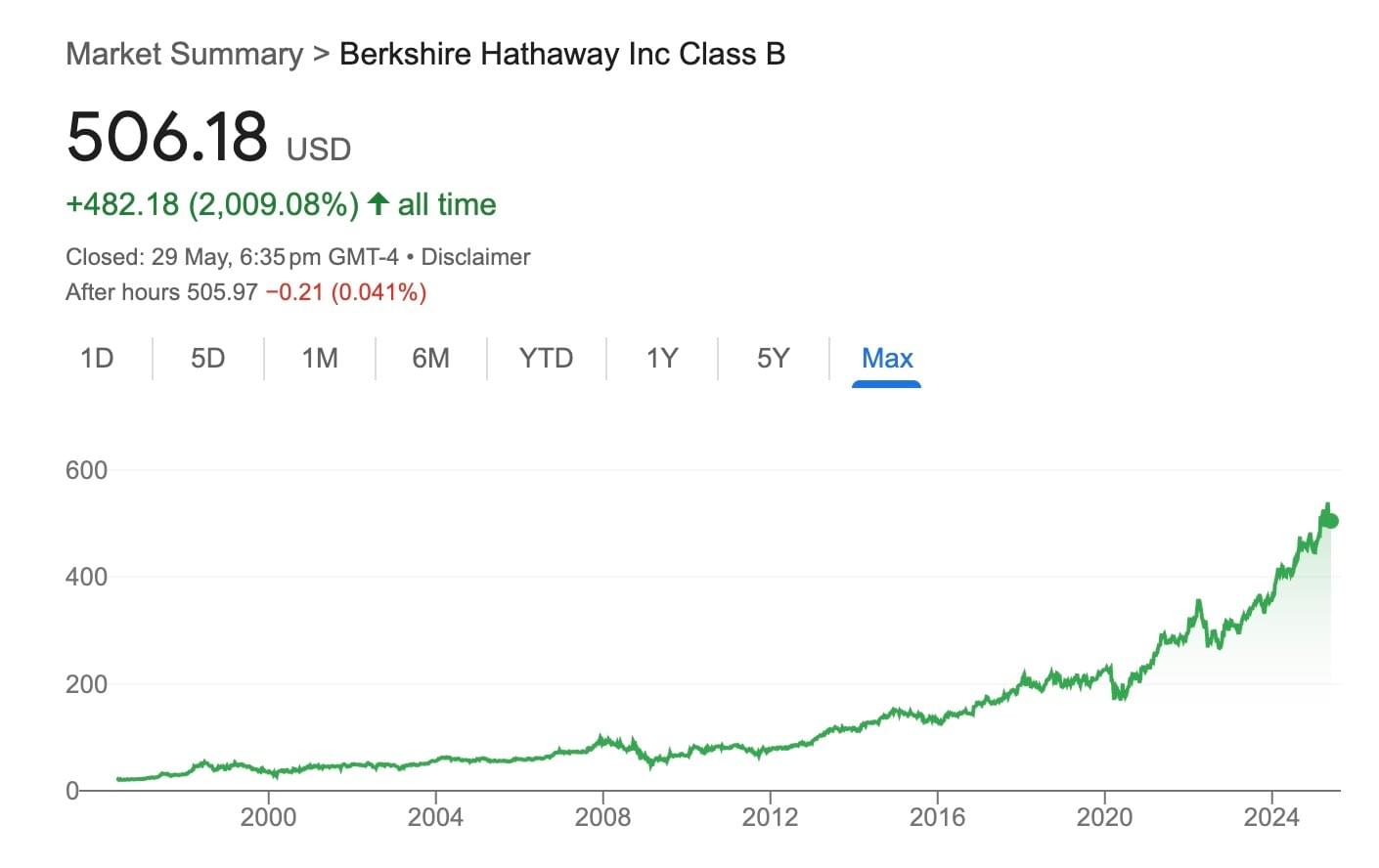

Here’s How Berkshire Hathaway Has Performed Over Time

Over 5 years, Berkshire has generated a 172.76%% return.

That’s impressive!

But here’s the mind-blowing part:

Let’s take a look at how Berkshire has performed since it was first listed…

Class B shares of Berkshire Hathaway started trading in 1996.

If you had invested in Berkshire back in 1996, you would have more than 21x-ed your capital!

Does that change your perspective on value investing?

Here’s Where It Gets Even More Interesting…

While value investing builds your foundation and lays the groundwork…

What if you could turn that solid foundation into a powerhouse?

That’s where options come in.

Used the right way, they don’t replace value investing — they enhance it, supercharging your portfolio performance.

We call this the Buffett Accelerator Framework:

1) One that drives long-term growth through quality stock selection.

2) The other generates consistent cash flow through strategic options plays — even in sideways or choppy markets.

For example... let’s say you’ve found a solid stock you’d love to own… but only at a cheaper price.

Instead of just waiting, you can use the B.O.S.S. options strategy.

You agree to buy a quality stock at a price you’re comfortable with, but you get paid upfront for making that promise.

If the stock price falls to or below your target, you buy it at your ideal price, effectively getting in cheaper, plus you keep the premium you were paid.

If the stock price doesn’t drop, you keep the premium as income, with no obligation to buy.

It’s a win either way.

Or let’s say you already own a great company.

You can use Strategy X on your stocks to earn monthly income while still holding them for long-term growth.

Think of it as collecting “rent” — you get paid a premium upfront for your stock every month.

This strategy boosts your overall returns, especially when the stock price is flat or growing slowly.

Plus, the premium you receive acts as a buffer, softening the impact if the stock price drops.

These are calculated options strategies that fit right to brilliantly enhance the value investor’s playbook.

Think of it like this: value investing builds your engine, but options install a turbocharger, transforming a solid ride into a high-performance machine.

But of course, these strategies aren’t just simple tricks — they’re powerful, high-income skills, and like any other valuable skills, knowing exactly how to use them is key to avoiding costly mistakes.

Now if you’re still reading this letter, I want to congratulate you for pressing on…

Because you’re going to receive an amazing deal!

You’ll Get To Discover All Of This In Our

Upcoming LIVE BOS MBA Class For FREE!

So here’s the deal for you:

My team of experienced coaches personally hand-picked by me will be conducting a 2-day LIVE workshop on the fundamentals of Buffett-style investing.

This LIVE workshop is called the BOS MBA.

During this workshop, we will teach you everything you need to know about the Buffett Accelerator Framework which have helped me to generate most of the wealth I have now.

These fundamentals are what we learnt from the Buffett family years ago…

And my team used to charge a grand total of $4,297 for the content in the BOS MBA.

But due to the massive need I see in newer investors today, I’ve decided to make this course completely FREE for you.

If you’re an experienced investor, the BOS MBA will be a good refresher to help you optimise your portfolio for higher returns in 2025.

Here’s what you’ll learn during the 2-day BOS MBA:

- Buffett Investing 101: The lost fundamentals behind Berkshire Hathaway's value investing success

- What to Buy (Criteria): Use our proven combination of fundamental and technical analysis (FA + TA) to identify great companies worth investing in.

- When to Buy (Valuation): How to calculate intrinsic value and find out what a company is truly worth

- How Much to Buy (Position Sizing): The golden guidelines to ensure you protect your downside and control your portfolio risk

- When to Sell (Review of Portfolio): Simple exit strategies to help you realise your gains or cut your losses the right way without panic or fear

- How to Create A Portfolio (Portfolio Building): Portfolio construction methods to massively grow your long-term wealth in the next 10+ years...

- Powerful Options Strategies – B.O.S.S. & Strategy X (Go beyond just buying stocks) to generate consistent income and supercharge your portfolio in any market.

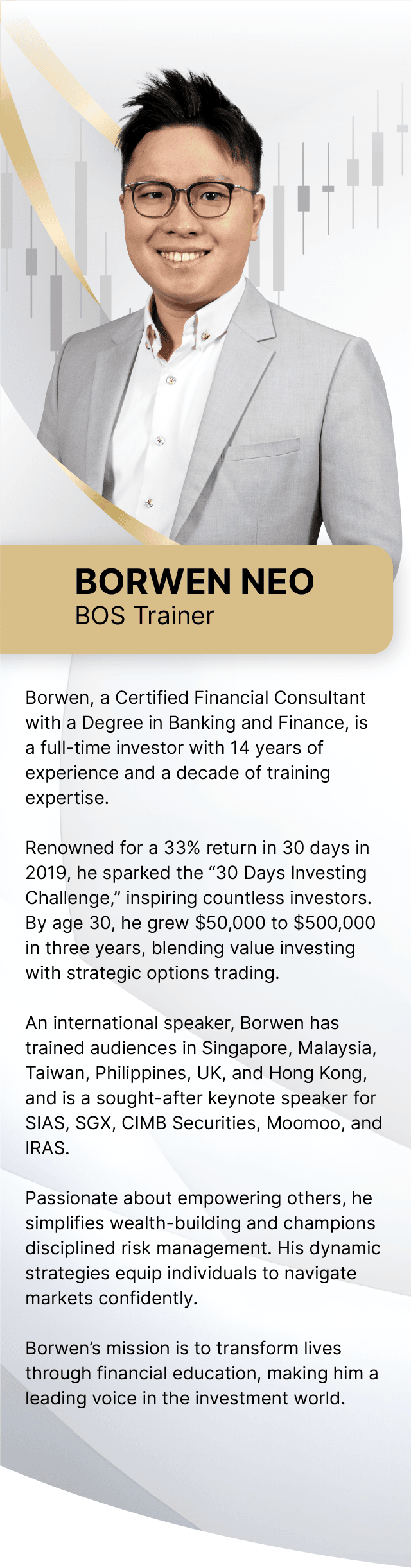

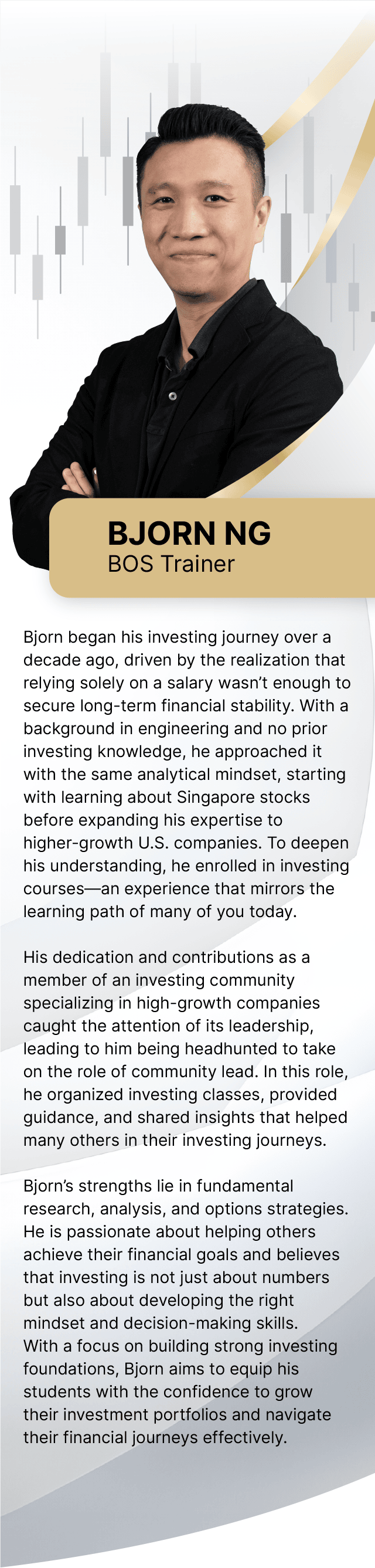

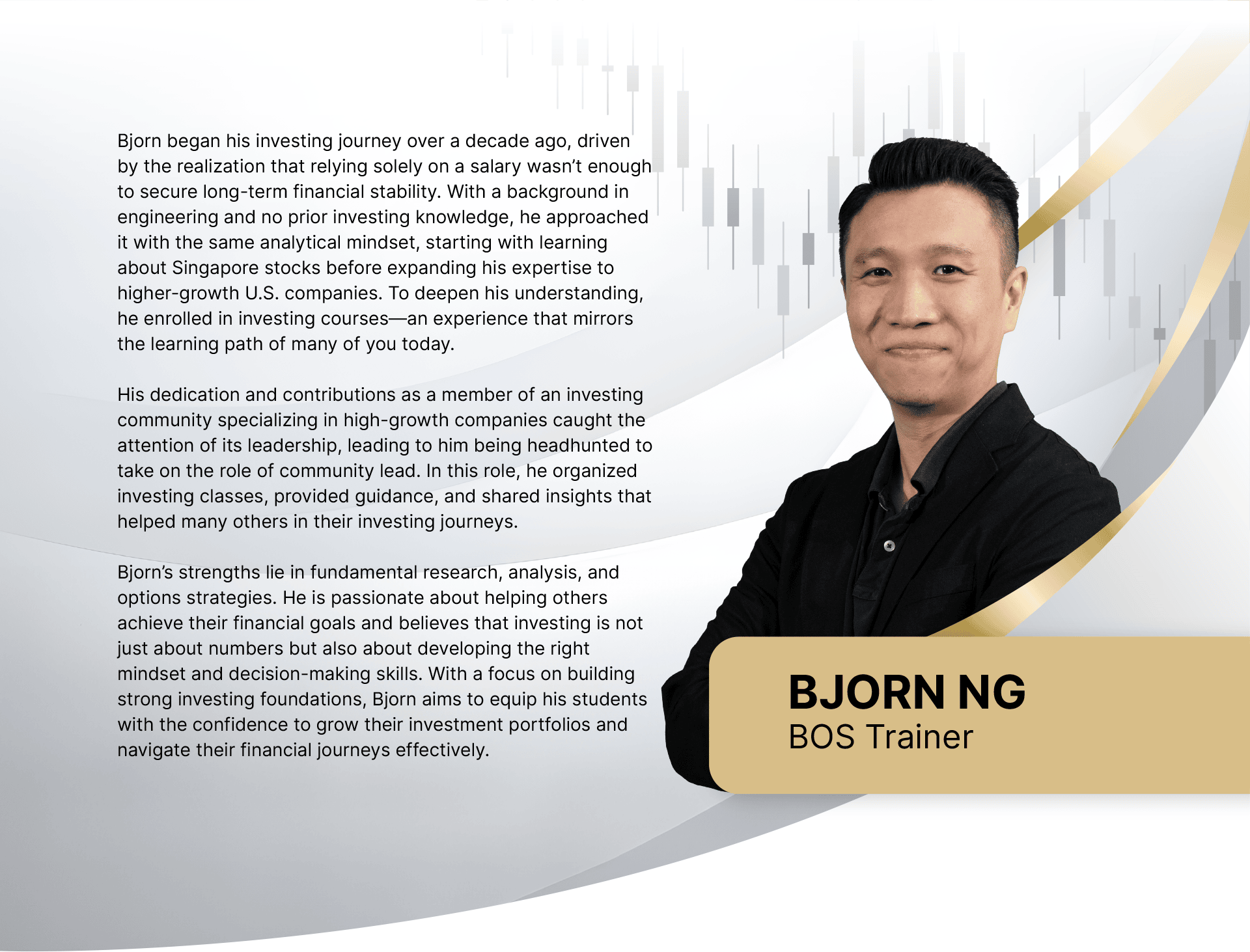

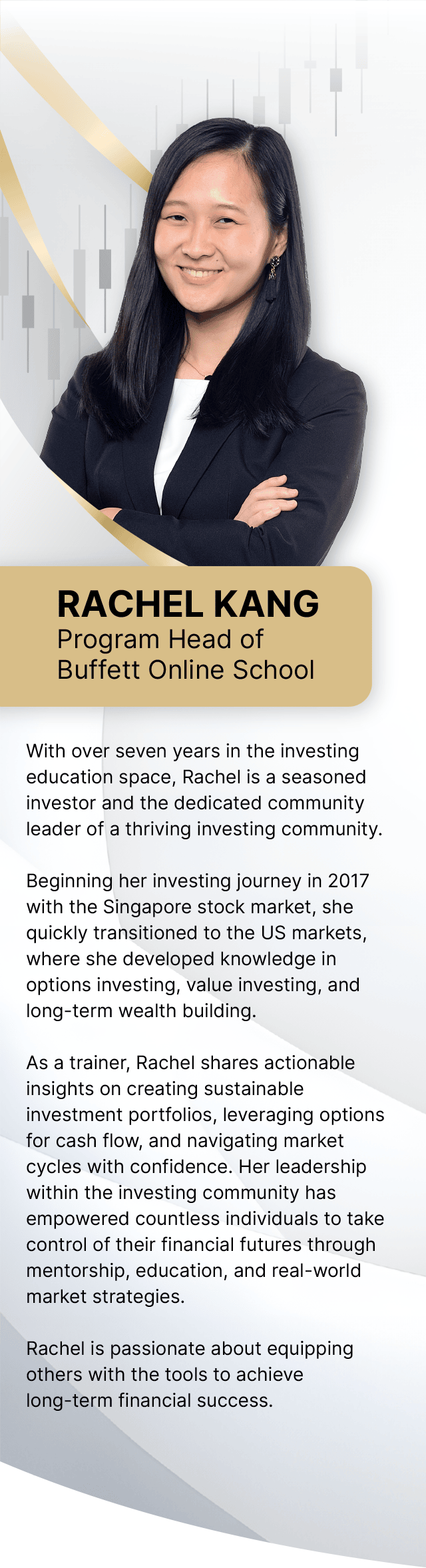

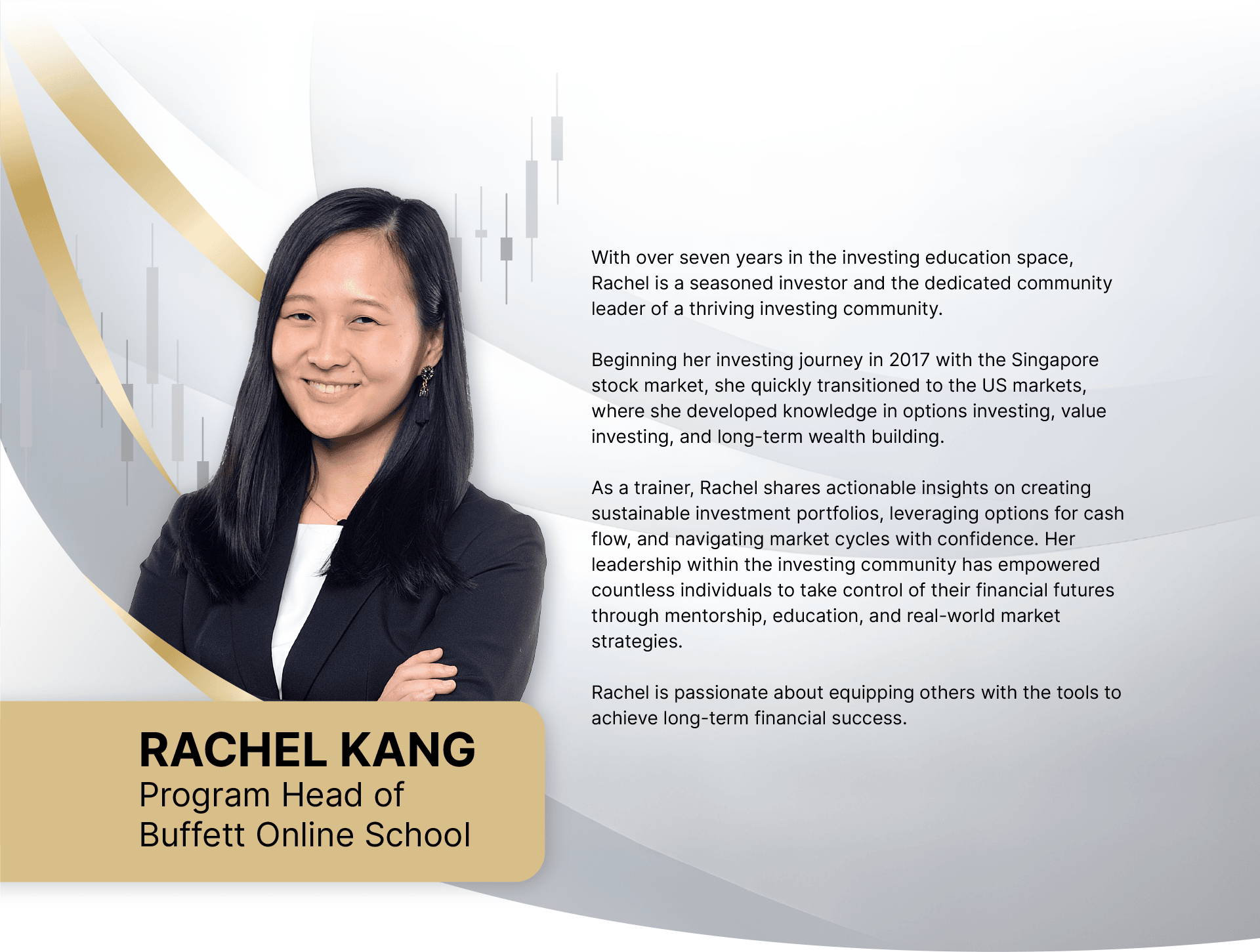

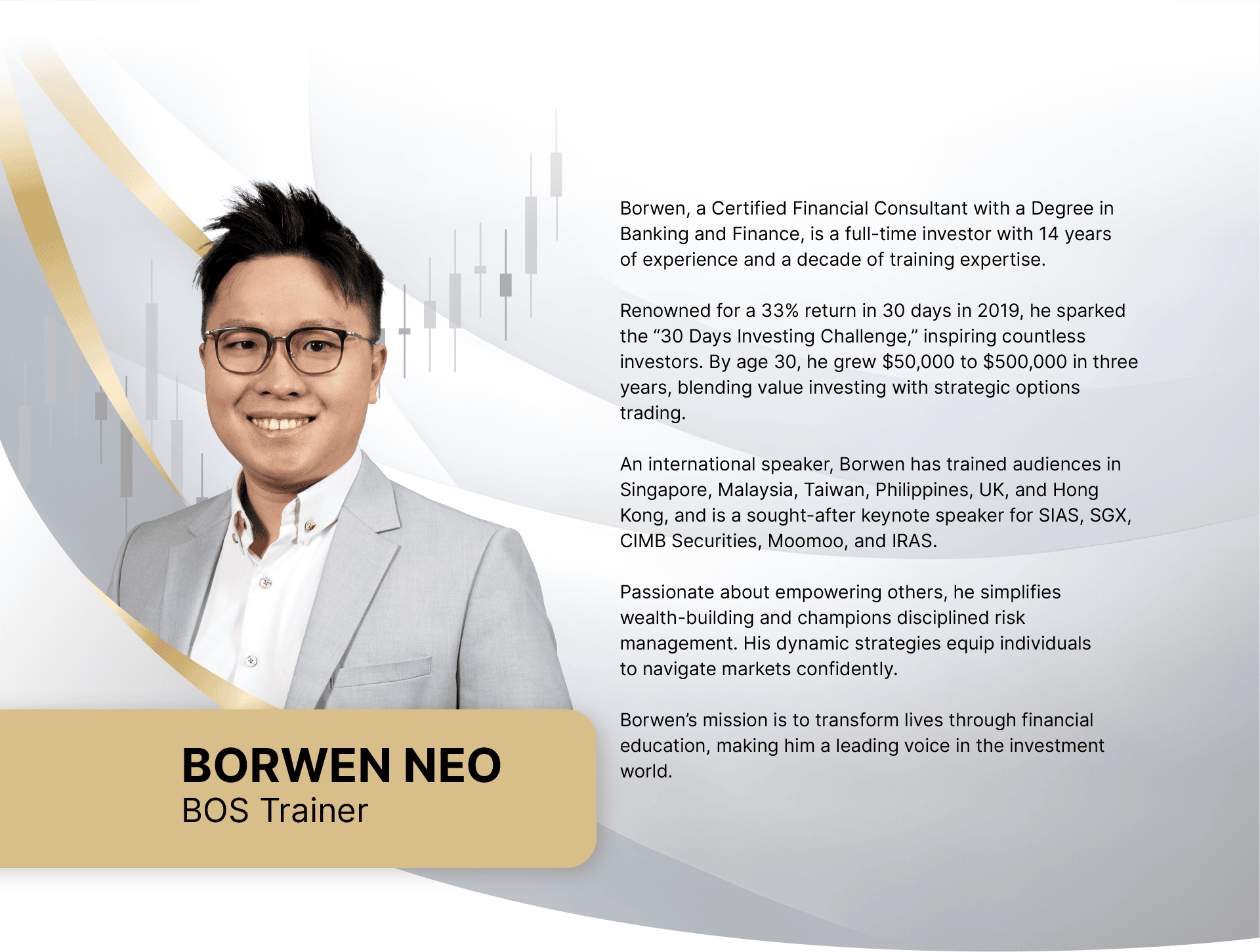

Meet Your BOS Trainers

Meet Your BOS Trainers

Hear Directly from Our Past BOS MBA Graduates About BOS MBA:

Do You Want To Grab The Huge Opportunities In The Stock Market Now?

Register now for the BOS MBA and start your 2025 investing journey the right way!

This workshop was once priced at $4,297, but I’m offering it now for FREE — because I want to help investors like you succeed in today’s challenging market.

P.S. only for a limited time, so don’t miss out!

Cheers to your wealth,

Rachel Kang

Program Head of Buffett Online School

Next Level Academy | Copyright © 2025 | All Rights Reserved

This website is developed and operated by Mary Buffett Business Pte. Ltd. We are an Education company and hence is NOT regulated or licensed by MAS as we do not provide investment services. All forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone. You are recommended to seek advice from a professional financial advisor if you have any doubts.